Oklahoma Business Entity Search: A Guide to Finding Businesses

We know that starting a business in Oklahoma can be exciting, but it can also feel confusing. You might be looking for information on how to conduct an Oklahoma business entity search to check if your chosen business name is available or to make sure you follow the rules set by the state. Don’t worry; we’re here to help! In this article, we’ll show you how to do an Oklahoma business entity search step by step, making it easy for you to find the information you need. Keep reading to learn how to get started on the right path for your business!

Key Takeaways

- Conducting a business entity search helps ensure name availability in Oklahoma.

- The Oklahoma Secretary of State plays an important role in business registrations.

- Understanding compliance requirements is vital for business success in the state.

Understanding Business Entities in Oklahoma

Oklahoma has a variety of business entities, each serving different goals and needs. The choice of entity affects legal liability, tax obligations, and operational flexibility. It is important for business owners to understand these distinctions.

Types of Business Entities

In Oklahoma, the main types of business entities include:

- Sole Proprietorship: Owned by one individual. It is the simplest structure, but the owner is personally liable for debts.

- Partnership: This can be a general partnership or a limited partnership. In a general partnership, all partners manage the business and share profits. In a limited partnership, some partners have limited liability.

- Limited Liability Company (LLC): Offers the benefits of limited liability for owners, known as members, while allowing for flexibility in management and taxation.

- Corporation: This is a more complex structure that separates personal and business liabilities. Corporations can issue stock and attract investors but have more regulatory requirements.

Each type has specific advantages and disadvantages that business owners need to weigh carefully.

Importance of Entity Structure

Choosing the right entity structure is critical for several reasons. It impacts legal liability, meaning how much personal risk the owner has if the business faces lawsuits or debts.

The selected structure also influences taxation. For example, an LLC can choose to be taxed as a sole proprietorship, partnership, or corporation, which can lead to tax savings.

Additionally, different structures can affect funding options. Corporations can issue stock to raise capital, while sole proprietorships may find it harder to secure large investments. Understanding these factors helps ensure the long-term success and security of the business.

The Oklahoma Secretary of State’s Role

The Oklahoma Secretary of State plays a vital part in managing business regulations and providing important services. Their responsibilities involve overseeing business registrations and ensuring information is accessible to the public.

Responsibilities and Services

The Oklahoma Secretary of State handles various responsibilities to support businesses. This includes the registration of entities like Limited Liability Companies (LLCs), corporations, and partnerships.

They maintain a database that tracks business names and statuses. This ensures that companies comply with state laws and operate legally.

Additionally, the office provides guidelines for establishing a business. They also offer resources for filing annual reports and updating business information. By ensuring transparency, they help protect consumers and foster trust in the business environment.

Accessing Business Records

Accessing business records is straightforward through the Oklahoma Secretary of State’s website. Individuals can perform a business entity search using the online tools provided.

Users can check if a business name is available or learn about an existing entity. This online service simplifies the process for entrepreneurs looking to start a new venture.

To obtain detailed information, users may need to provide some basic contact details. The office ensures that business records are accessible to the public, promoting accountability and awareness in the Oklahoma business community.

Conducting Oklahoma Business Entity Search

Searching for business entities in Oklahoma can provide important information about companies, their statuses, and ownership. Knowing the steps to effectively conduct this search and interpret the results is useful for anyone interested in business regulations within the state.

Step-by-Step Guide to Oklahoma Business Entity Search

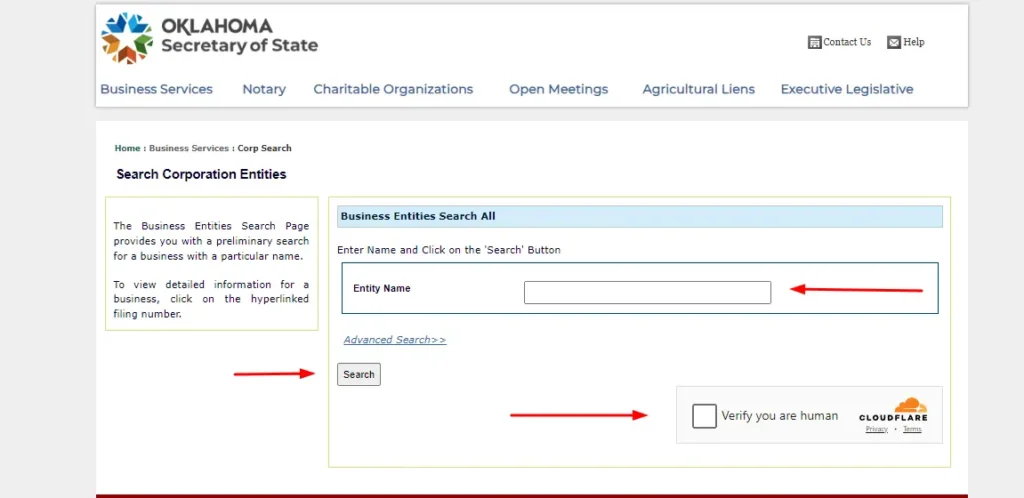

- Visit the Oklahoma Secretary of State Website: Start by going to the Oklahoma Secretary of State’s business entity search page.

- Choose Search Type: For a basic search, enter the entity name directly in the search box.

- Input Criteria: Type the business name or relevant information in the provided field.

- Review Results: After clicking the ‘Search’ button, you’ll see a list of entities that match your criteria. Click on any entity name for detailed information about its registration.

Advanced Search

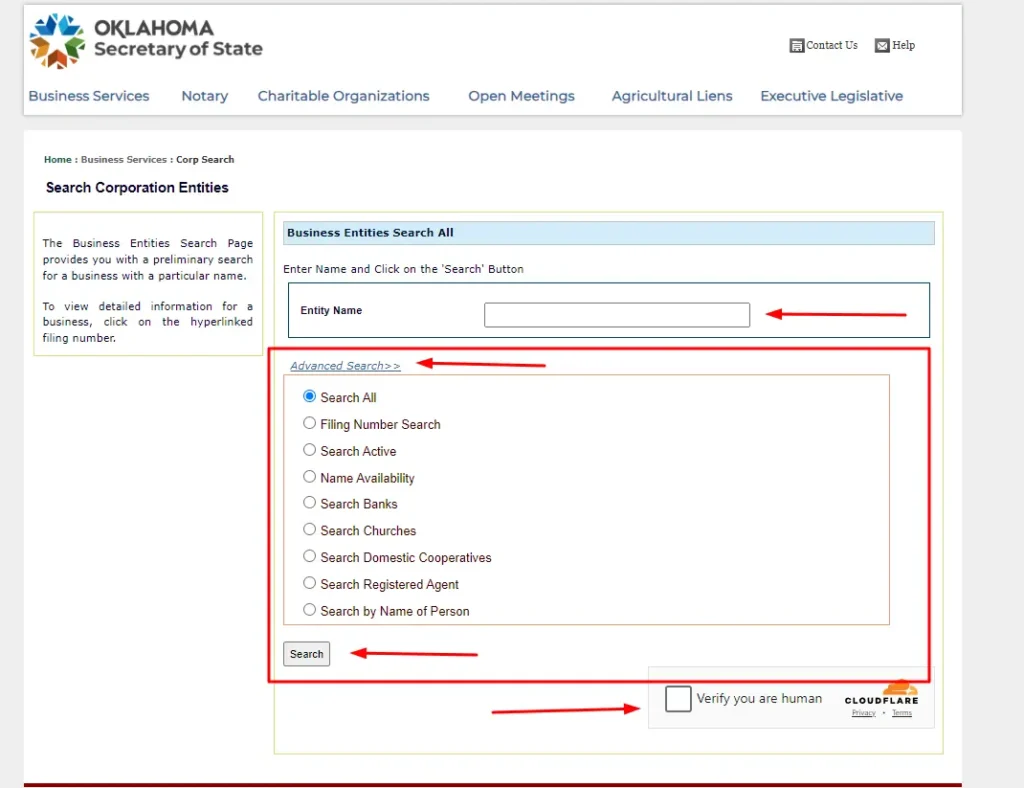

- Select Advanced Search: Click on the Advanced Search link or button on the business entity search page.

- Input Criteria: Use the following options to refine your search:

- Filing Number: Search by the business’s filing number.

- Search Active: Filter to find only active entities.

- Name Availability: Check if a business name is available.

- Search Banks: Look for registered banks.

- Search Churches: Find registered churches.

- Search Domestic Cooperatives: Locate domestic cooperatives.

- Search Registered Agent: Find the registered agent for an entity.

- Search by Name of Person: Search for entities associated with a specific person’s name.

Review Results: After entering your criteria, click the ‘Search’ button to see the results. Click on any entity name to access detailed information about its registration.

Understanding Search Results

The search results from the Oklahoma Secretary of State reveal important details about each business. This includes the entity’s name, type, status, and registration date.

- Entity Name: The official name is registered in Oklahoma.

- Entity Type: Categorizes the business, such as Limited Liability Companies (LLCs) or Corporations.

- Status: Displays if the entity is active, inactive, or dissolved.

It’s important to check the registration date to understand how long the business has been established. If more detailed reports are needed, users can contact the Oklahoma State Business Services Division through email or phone.

Oklahoma Tax ID Number Search

In Oklahoma, a Tax ID number, also known as an Employer Identification Number (EIN), is important for businesses. This number is used for tax purposes and helps identify businesses at the federal and state levels.

To obtain a Tax ID number, one can visit the Oklahoma Secretary of State website. It offers resources for finding business information including Tax ID details.

Key Steps for the Search:

- Visit the Oklahoma Secretary of State: Start at the official site.

- Access the Business Entity Search tool: This tool allows users to search for information related to registered businesses.

- Enter Business Information: Input the business name or other identifying details to locate the Tax ID.

Businesses may also need to provide additional contact information to access detailed records.

Important Note:

- Annual Fee Requirements: Some entities must pay annual fees to maintain their status. For instance:

- LLCs: $25.00

- Limited Partnerships: $55.00

It is important for business owners to keep their information up to date to avoid any penalties. Regular checks on their Tax ID status can help in maintaining compliance with state regulations.

Compliance and Legal Considerations

Business owners must adhere to various compliance and legal requirements when operating within Oklahoma. Understanding these responsibilities is vital for maintaining a good standing and avoiding legal issues. Key aspects include ongoing compliance obligations and the legal implications tied to the business entity’s status.

Continued Compliance Requirements

In Oklahoma, businesses are required to fulfil certain ongoing compliance obligations. These may include:

- Annual Reports: Many entities must file an annual report to provide updated information to the Secretary of State.

- Tax Filings: Compliance with state and federal tax requirements is important. This includes sales tax and income tax.

- Licenses and Permits: Depending on the business type, specific licenses and permits may need to be renewed regularly.

Failure to meet these obligations can lead to penalties or loss of business status. Regularly reviewing compliance needs helps businesses operate smoothly and maintain good standing.

Legal Implications of Entity Status

The legal structure of a business affects its liabilities and obligations. For instance, a corporation offers limited liability protection to its owners, shielding personal assets from business debts. In contrast, a sole proprietorship does not provide this protection, exposing the owner’s personal assets to risk.

Understanding the implications of different entity types helps owners make informed decisions. They must also be aware of the legal requirements linked to their chosen structure, which may include specific regulations, filing fees, and operational guidelines. Keeping up with these legalities is important for long-term success.

Resources and Assistance

Accessing the right resources can greatly help business owners in Oklahoma. There are many tools and organizations available to provide support and information tailored to their needs.

Support for Business Owners

Oklahoma offers various support systems for business owners. The Oklahoma Business Hub is a centralized place where individuals can find important services related to starting and growing a business. This hub provides information on necessary permits, licenses, and tax obligations.

Local Small Business Development Centers (SBDCs) also offer assistance.

They provide free consultations, training, and resources for entrepreneurs. Additionally, the Oklahoma Secretary of State’s website features an online business entity search tool. This resource helps business owners verify the status of registered entities and access important information for business operations.

Further Information and Guidance

For those seeking more detailed information, the Oklahoma Secretary of State’s Business Services section can help. They clarify filing requirements and necessary compliance actions. You can contact them at the Business Filing Department, 421 N.W. 13th, Suite 210, Oklahoma City, OK 73103.

Business owners can also benefit from various industry associations. These organizations offer networking opportunities, industry best practices, and updated information on regulations. By tapping into these resources, entrepreneurs can better navigate the complexities of running a business in Oklahoma.

Frequently Asked Questions About Oklahoma Secretary of State Business Entity Search

This section addresses common inquiries regarding business entity searches in Oklahoma. It provides clear guidance on how to check business name availability, look up an LLC, and understand licensing processes, among other relevant topics.

How can I check if a business name is available in Oklahoma?

To check if a business name is available in Oklahoma, individuals can use the name availability tool. This tool helps to see if the desired name complies with state guidelines and if it is not already in use.

How do I look up an LLC in Oklahoma?

Searching for an LLC in Oklahoma can be done through the Oklahoma Secretary of State’s website. Users can enter the LLC name in the search box to find relevant information about the business.

What is the process for obtaining a business license in Oklahoma?

To obtain a business license in Oklahoma, one must complete the registration process through the state’s official channels. This often includes filling out forms and paying necessary fees to the appropriate government offices.

How do you find the owner of a registered company in Oklahoma?

Finding the owner of a registered company in Oklahoma can involve searching the business entity database. The database may provide details about the business owner along with other relevant information.

What are the steps to obtain an Oklahoma Secretary of State filing number?

To obtain a filing number from the Oklahoma Secretary of State, a business must complete the required registration forms. After submitting these forms and paying any applicable fees, the business will receive its filing number.

Where can I find information on Oklahoma business entity registration requirements?

Information on Oklahoma business entity registration requirements can be accessed through the Oklahoma Secretary of State website. This resource provides comprehensive details on what is needed to register a business.

How to locate or verify a Tax ID number in Oklahoma for a business

Contact the Oklahoma Tax Commission to locate or verify a Tax ID number in Oklahoma. They offer resources and assistance to help individuals find or confirm their business’s Tax ID number.

Conclusion

Conducting an Oklahoma business entity search is essential for anyone starting or running a business. It helps you check if your business name is available and understand the rules you need to follow. We hope this guide has provided useful information. For more questions, be sure to explore the resources from the Oklahoma Secretary of State.